UNITED STATES

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | ☒ | |

| Filed by a Party other than the Registrant | ☐ | |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

ACCO BRANDS CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | ||

| Filing Party: |

| (4) | ||

| Date Filed: | ||

![[ACCO BRANDS]](https://capedge.com/proxy/DEF 14A/0001626129-17-000136/accodef051017001.jpg)

March 30, 201528, 2017

Dear Fellow Stockholder:

ACCO Brands delivered better-than-expected results in 2014. In spite of currency pressures and a consolidating customer base, our ACCO Brands team grew earnings, significantly reduced debt, initiated a stock buy-back program, and improved most operating ratios. ACCO Brands stock price was up 34% in 2014, significantly outperforming both the S&P 500 and Russell 2000 stock indices. We are proud of the team’s accomplishments in this difficult environment.

In 2015, the Company will continue to focus on improving profitability and managing channel transition in mature markets, and growing sales and profitability in emerging markets. With a stronger balance sheet, the Company will also continue to evaluate share buy-backs and acquisitions as ways to further enhance shareholder value. We remain confident that we have the right strategy and management team to increase the long-term value of our Company.

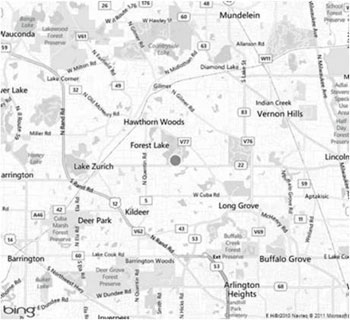

We invite you to join the Board of Directors and our management team at the ACCO Brands Corporation 20152017 Annual Meeting of Stockholders, which will be held at 10:30 a.m. (Central Time) on Tuesday, May 12, 201516, 2017 at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois. A map with directions to the Kemper Lakes Business Center can be found at the end of the attached Proxy Statement. The sole purpose of the meeting is to consider the matters described in the following Notice of 20152017 Annual Meeting and Proxy Statement.

2016 was a great year for ACCO Brands and its stockholders. We met or exceeded nearly every operational or financial objective that we had set for the year. Each of our business segments contributed to revenue growth or profit improvement. We gained share with key customers and in strategic categories, increased operating margins, generated significant free cash flow, and strengthened our balance sheet. We announced two acquisitions, including Pelikan Artline in Australia, completed May 2, 2016, and Esselte in Europe, completed January 31, 2017. Both present excellent opportunities for consumer, customer and stockholder value creation in the years to come.

We believe our operating success and strategic accomplishments during the year were well recognized by the market - our stock price was up 83% in 2016 and 94% over the three year period ending December 31, 2016.

For 2017, our strategy remains consistent. We will continue to manage our mature markets, categories and channels for profit. We will maintain our commitment and rigor around execution and productivity initiatives, including delivering on integration and synergies for the two acquisitions. We will prudently invest in emerging markets, new channels and new products with an expectation for top and bottom line growth. And, as always, we will focus on generating strong cash flow. We remain confident that we have the right strategy and management team to increase the long-term value of our Company.

It is important that your shares are represented at the meeting, whether or not you plan to personally attend. You can submit your proxy by using a toll-free telephone number, by mail or through the Internet, or you can vote in person at the meeting. Instructions for using these services are provided on the accompanying proxy form.card. If you decide to vote your shares using the accompanying proxy form,card, we urge you to complete, sign, date and return it promptly.

Sincerely,

![[BORIS ELISMAN]](https://capedge.com/proxy/DEF 14A/0001626129-17-000136/accodef051017002.jpg) | |

|   |

| Robert H. Jenkins | |

Chairman of the Board, President and Chief Executive Officer | Presiding Independent Director |

NOTICE OF 20152017 ANNUAL MEETING

AND PROXY STATEMENT

The Annual Meeting of Stockholders of ACCO Brands Corporation (“ACCO Brands” or the “Company”) will be held at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois, 60047, at 10:30 a.m. Central Time on Tuesday, May 12, 2015,16, 2017, for the following purposes:

| Item 1: | To elect |

| Item 2: | To ratify the selection of KPMG LLP as our independent registered public accounting firm for |

| Item 3: | To approve, by non-binding advisory vote, the compensation of our named executive officers; |

| Item 4: | To approve, by non-binding advisory vote, the |

| Item 5: | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

We currently are not aware of any other business to be brought before the 20152017 Annual Meeting (the “Annual Meeting”). Only holders of record of common stock at the close of business on March 13, 201522, 2017 will be entitled to vote at the Annual Meeting or at any adjournment or postponement thereof.

Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) by telephone, (2) through the Internet or (3) by mail. For specific instructions, please refer to the accompanying proxy card. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

This year we are again taking advantage of Securities and Exchange Commission (“SEC”) rules that allow us to furnish proxy materials to our stockholders via the Internet. We will send a Notice of Internet Availability of Proxy Materials (the “Notice”) to holders of our common stock as of the record date on or about March 30, 2015.28, 2017. The Notice describes how you can access our proxy materials, including this Proxy Statement, beginning on March 30, 2015.28, 2017.

We also are soliciting voting instructions from participants in the ACCO Brands Corporation 401(k) plan who hold shares of our common stock under the plan. We ask each plan participant to sign, date and return the accompanying voting instruction card or provide voting instructions by telephone or through the Internet as described on the voting instruction card.

|

By order of the Board of Directors

Pamela R. Schneider

Senior Vice President, General Counsel

and Corporate Secretary

This Proxy Statement and accompanying proxy are first being made available or distributed to our

stockholders on or about March 28, 2017.

PROXY STATEMENT - HIGHLIGHTS

This summary highlights certain information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider. You should read the entire Proxy Statement carefully before voting.

ACCO Brands Corporation Annual Meeting of Stockholders

Time and Date: 10:30 2015.a.m. Central Time on Tuesday, May 16, 2017

Place: Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois 60047

Record Date: March 22, 2017

Proposals to be Voted on and Board Voting Recommendations

| Proposals | Board Recommendations | Page No. | |||||||||

| Item 1 |

| FOR each nominee | 5 | ||||||||

| Item 2 | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal | 2017 | FOR | 21 | |||||||

| Item 3 | “Say-on-pay” advisory vote on the compensation of our named executive officers | FOR | 53 | ||||||||

| Item 4 | Frequency of future advisory votes on the compensation of our named executive officers | ||||||||||

| 54 | |||||||||||

Corporate Governance

Board of Directors and Committees

| Declassified Board of Directors - all directors elected annually | ||||

| 80% of our directors are independent |

| Fully independent Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee |

| Executive sessions of |

| All directors attended over |

Stockholder Interests

| ● | Majority voting standard for election of directors in uncontested elections |

| All directors and executive officers have met or are on track to meet stock ownership guidelines | ||||

| Annual |

| Hedging, pledging and short sales of company stock are prohibited |

Executive Compensation

Boris Elisman, Chairman of the Board, President and Chief Executive Officer

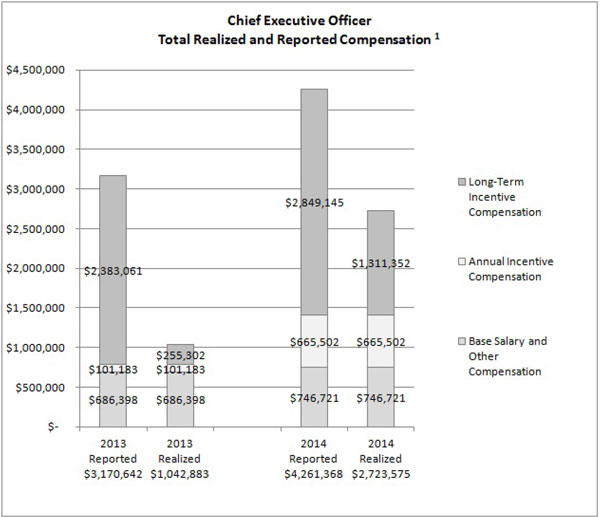

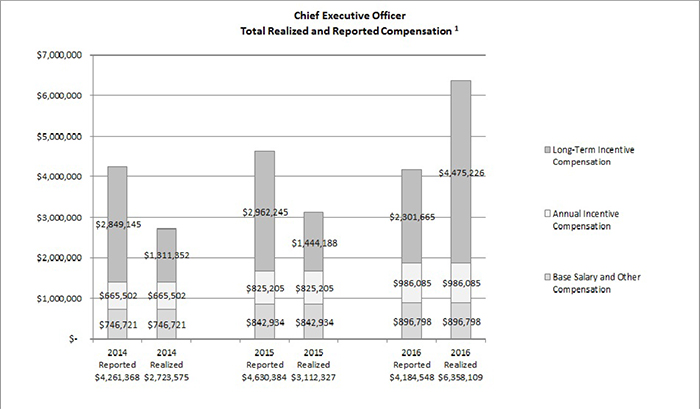

Fiscal 2016 Total Realized Compensation

| ● | ||||

| ● | |||

| Long-Term Incentive |

Compensation Highlights

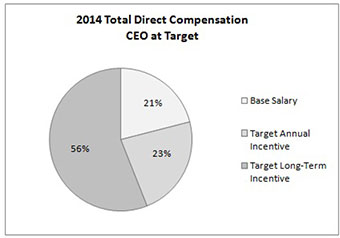

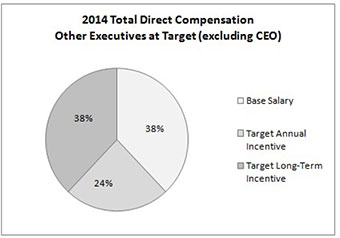

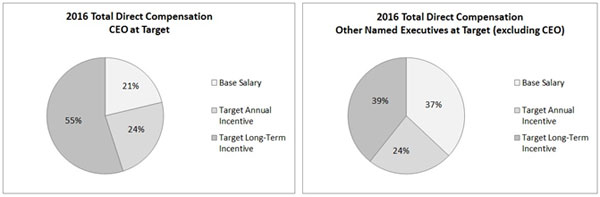

| 79% of CEO target compensation is at-risk based on financial performance measures or stock price appreciation | ||||

| No executive employment agreements or individual change-in-control agreements |

| Clawback and recoupment policy |

| Independent compensation consultant |

| Annual compensation risk assessment |

| Three-year performance period for |

| Double-trigger change-in-control provisions in executive severance plan |

| ● | Incentive compensation plan includes good corporate governance features such as: |

| Double-trigger |

| ○ | One-year minimum vesting requirements |

| ○ | No broad discretion to accelerate vesting |

| ○ | No liberal share recycling provisions |

| ○ | No stock option repricing, cash buyouts, or discounted stock options |

VOTING AND PROXIES

Why is ACCO Brands distributing this Proxy Statement?

Our Board of Directors is soliciting proxies for use at the Annual Meeting to be held on Tuesday, May 12, 2015,16, 2017, beginning at 10:30 a.m. Central Time, at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois. In order to solicit your proxy, we must furnish you with this Proxy Statement, which contains information about the matters to be voted upon at the Annual Meeting.

What is the purpose of the Annual Meeting?

The purpose of the Annual Meeting is for stockholders to act upon the matters outlined in the Notice of the Annual Meeting and described in this Proxy Statement, including: (1) the election of tennine directors, (2) the ratification of KPMG LLP as our independent registered public accounting firm for 2015,2017, (3) a non-binding advisory vote on the compensation of our named executive officers, (4) a non-binding advisory vote on the approvalfrequency of holding an advisory vote on the ACCO Brands Corporation Incentive Plan (the “Restated Plan”),compensation of our named executive officers, and (5) such other business as may properly come before the meeting or any adjournment or postponement thereof. In addition, management will be available to respond to questions from stockholders.

Why did I receive a Notice in the mail regarding the availability of proxy materials on the Internet instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials via the Internet. The Notice we sent to our stockholders provides instructions on how to access and review this Proxy Statement and our Annual Report online, as well as how to vote online. Providing proxy materials electronically significantly reduces the printing and mailing costs associated with the distribution of printed copies of our proxy materials to our stockholders.

If you receive a Notice, you will not receive a printed copy of the proxy materials by mail unless you request one. All stockholders have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request printed copies may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail on an ongoing basis.

Who is entitled to vote?

Only stockholders who own ACCO Brands common stock of record at the close of business on March 13, 201522, 2017 are entitled to vote. Each holder of common stock is entitled to one vote per share. There were 112,285,889109,510,800 shares of common stock outstanding on March 13, 2015.22, 2017.

What is the difference between being a record holder and holding shares in street name?

A record holder holds shares in his or her own name. Shares held in “street name” are shares that are held in the name of a bank, broker or other nominee on a person’s behalf. If the shares you own are held in “street name” by a bank, broker or other nominee,name,” the bank, broker or other nominee is required towill vote your shares according to your instructions. Under the rules of the New York Stock Exchange (“NYSE”), if you do not give instructions to your bank, broker or other nominee, it will still be able to vote your shares with respect to certainon any “discretionary” items but will not be allowed to vote your shares with respect to certain “non-discretionary” items.

Only the ratification of KPMG LLP as our independent registered public accounting firm (proxy Item 2) is considered to be a discretionary item under the NYSE rules, and your bank, broker or other nominee will be able to vote on that item even if it does not receive voting instructions from you, so long as it holds your shares in its name.

The election of directors (proxy Item 1), the advisory vote on the compensation of our named executive officers (proxy Item 3), and the approvaladvisory vote on the frequency of holding an advisory vote on the Restated Plancompensation of our named executive officers (proxy Item 4) are “non-discretionary”non-discretionary items. Therefore, if you hold your shares in street name,“street name”, your bank, broker or other nominee may not vote your shares with respect to these items unless it receives your voting instructions.Non-discretionary proxy items as to which no voting instructions and if it does not, those votes will beare received are counted as “broker non-votes.” “Broker non-votes”Broker non-votes are shares that are held in “street name” by a bank, broker or other nominee that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

How do I vote?

Stockholders of record can vote by filling out the accompanying proxy card and returning it as instructed on the proxy card. You can also vote by telephone or through the Internet by following the instructions printed on the proxy card or the Notice. You may also vote in person at the meeting.

Stockholders thatwho hold shares in “street name” can vote by following the voting instructions in the materials received from your bank, broker or other nominee. The availability of telephone and Internet voting for stockholders thatwho hold shares in “street name” will depend on the voting processes of your bank, broker or other nominee. Therefore, we recommend that you follow the voting instructions in the materials you receive from your bank, broker or other nominee. In addition, you may only vote in person if you obtain a signed proxy from your bank, broker or other nominee, who is the holder of record.

How will my proxy be voted?

Your proxy, when properly signed and returned, or processed by telephone or through the Internet, and not revoked, will be voted in accordance with your instructions. We are not aware of any other matter that may be properly presented other than the election of directors, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2015,2017, the advisory vote on the compensation of our named executive officers, and the approvaladvisory vote on the frequency of holding an advisory vote on the Restated Plan.compensation of our named executive officers. If any other matter is properly presented at the meeting, the persons named in the enclosed form of proxy will have the authority to vote on such matters at their discretion.

What constitutes a quorum?

The holders of a majority of the issued and outstanding common stock of the Company present either in person or by proxy at the Annual Meeting will constitute a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting. If less than a majority of the outstanding shares of common stock are represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting to another date, time or place.

What if I don’t mark the boxes on my proxy or voting instruction?

If you hold shares in your name, unless you give other instructions on your form of proxy or when you cast your proxy by telephone or through the Internet, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. In summary, the Board of Directors recommends a vote:

| FOR the election of each director nominee (proxy Item 1); |

| FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for |

| FOR the approval, on an advisory non-binding basis, of the compensation of our named executive officers (proxy Item 3) |

| FOR a frequency of EVERY YEAR for future advisory votes on the | ||

If you hold shares in “street name,” your bank, broker or other nominee may vote your shares on discretionary matters without receiving voting instructions from you, but cannot vote your shares on non-discretionary matters.items to be brought for a vote at the Annual Meeting. As a result, if you do not provide instructions, your bank, broker or other nominee will not have the authority to vote on proxy Item 1 (election of directors), proxy Item 3 (advisory vote on the compensation of our named executive officers), and proxy Item 4 (approval(advisory vote on the frequency of holding an advisory vote on the Restated Plan)compensation of our named executive officers), but will have the authority to vote on proxy Item 2 (ratification of independent auditors).

Can I go to the Annual Meeting if I vote by proxy?

Yes. Attending the meeting does not revoke your proxy unless you vote in person at the meeting.

Please note that attendance at the Annual Meeting is limited to stockholders of record as of the close of business on March 13, 2015,22, 2017, the record date, and to those who hold a valid proxy from a stockholder of record. Each stockholder and proxyholder may be asked to present valid picture identification, such as a driver’s license or passport, and proof of stock ownership as of the record date. Proof of ownership can be the Notice, your proxy card or a proxy or voting instruction card provided by your broker,

bank or other nominee, or a brokerage statement or letter from your bank or broker evidencing your ownership of ACCO Brands stock

as of March 13, 2015. Stockholders and proxyholders also may be asked to present a form of photo identification such as a driver’s license or passport.22, 2017. The use of cell phones, smartphones, electronic tablets, laptops and recording and photographic equipment is not permitted in the meeting room at the Annual Meeting. Failure to follow the meeting rules will be grounds for exclusion from the Annual Meeting.

How can I revoke my proxy?

You may revoke your proxy at any time before it is actually voted by giving written notice to the secretary of the Annual Meeting (if you attend the Annual Meeting) or by delivering a later-dated proxy, which automatically revokes your earlier proxy, either by mail, by telephone or through the Internet, if one of those methods was used for your initial proxy submission. If shares are held in a stock brokerage account or by a bank, broker or other nominee, then you are not the record holder of your shares, and while you are welcome to attend the Annual Meeting you will not be permitted to vote unless you obtain a signed proxy from your bank, broker or other nominee (who is the holder of record).

Will my vote be public?

No. As a matter of policy, stockholder proxies, ballots and tabulations that identify individual stockholders are kept secret and are only available to the independent InspectorsInspector of Election and certain employees who have an obligation to keep your votes secret.

How many votes are needed to elect directors and how will votes be counted?

Each nominee for director will be elected to the Board of Directors (proxy Item 1) if the votes cast for such nominee’s election exceeds the votes cast against such nominee’s election (with abstentions and broker non-votes not counted as a vote cast for or against that nominee’s election).Please note that if you hold your shares in “street name”, your bank broker or other nominee will not be permitted to vote your shares on proxy Item 1 (election of directors) absent specific instructions from you. Therefore, it is important that you follow the voting instructions on the form that you receive from your bank, broker or other nominee.

You may vote for or against each of the nominees for the Board of Directors, or you may abstain. If you abstain, your shares will be counted for purposes of establishing the quorum, but will have no effect on the election of the nominees.

In accordance with the Company’s Corporate Governance Principles, each director nomineesnominee has submitted a contingent, irrevocable resignation that the Board of Directors may accept if the nominee fails to receive the required vote for re-election. In that situation, the Corporate Governance and Nominating Committee (or a special committee consisting solely of independent directors not subject to a failed vote) would make a recommendation to the Board of Directors about whether to accept or reject the resignation, or whether to take other action. For additional information, see “Election of Directors--2017 Board of Director Nominees.”

How many votes are needed to approve the other matters to be voted upon at the Annual Meeting?Meeting and how will votes be counted?

Directors are elected by a plurality of all votes cast for the election of directors at the Annual Meeting. A proxy marked to withhold authority for the election of one or more directors will not be voted with respect to the director or directors indicated. The affirmative vote of the holders of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote is necessary for the approval of proxy Items 2 3 and 4. Proxy cards3. This means that of the number of shares represented at the meeting and entitled to vote on the matter, a majority of them must be voted for the proposal for it to be approved. Proxies marked as abstentions on proxy Items Items 2 3 and 4 will not be voted and3 will have the same effect as a vote against the proposal and broker non-votes will have no effect on the vote for the proposal.

The vote required to determine the frequency of the advisory vote on executive compensation (Item 4) is a negative vote. plurality of votes cast, which means that the frequency option that receives the most affirmative votes of all the votes cast is the one that will be deemed approved by the stockholders. Abstentions and broker non-votes will not affect the outcome of this proposal.

With respect to the other matters to be voted upon, you may vote for, against or abstain. If you abstain from voting for a proposal, you vote will have the same effect as a vote against the proposal.

Please note that if you hold your shares in street name,“street name”, your bank broker or other nominee will not be permitted to vote your shares on proxy Item 1 (election of directors), proxy Item 3 (advisory vote on the compensation of our named executive officers )officers) or proxy Item 4 (approval(advisory vote on the frequency of holding an advisory vote on the Restated Plan)compensation of our named executive officers) absent

3

specific instructions from you. Therefore, it is important that you follow the voting instructions on the form that you receive from your bank, broker or other nominee.

What if I participate in the ACCO Brands 401(k) plan?

We also are making this Proxy Statement available to and seeking voting instructions from participants in the ACCO Brands 401(k) plan who hold shares of our common stock under such plan. The trustees of the plan, as record holders of ACCO Brands common stock held in the plan, will vote whole shares attributable to you in accordance with your directions given on your voting instruction card, by telephone or through the Internet. If you hold shares of our common stock under the plan, please complete, sign and return your voting instruction card or provide voting instructions by telephone or through the Internet, as described on the voting instruction card, prior to May 7, 2015.11, 2017. The voting instruction card will serve as instructions to the plan trustees to vote the shares attributable to your interest in the manner you indicate on the card.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

Our Proxy Statement and 20142016 Annual Report on Form 10-K are available at: www.proxyvote.com.

ELECTION OFDIRECTORS

(Proxy Item 1)

Our By-laws currently provide that the Board of Directors may consist of not less than nine nor more than thirteen members. Currently, there are teneleven members serving on our Board of Directors. George V. Bayly and Robert H. Jenkins will retire at the Annual Meeting, following the expiration of their terms, and if all nominees are elected, the Board of Directors will consist of nine members immediately following the Annual Meeting. The Board of Directors, upon recommendation from the Corporate Governance and Nominating Committee (the “Governance Committee”), has selected all of the currently serving directors (other than Messrs. Bayly and Jenkins) as nominees for election as directors at the Annual Meeting.

Directors are responsible for overseeing the Company’s business consistent with their fiduciary duties to stockholders. The Board of Directors believes that there are general requirements applicable to all directors as well as other skills and experience that should be represented on our Board as a whole, but not necessarily in each director. The Board of Directors and the Governance Committee consider the entirety of the qualifications of directors and director nominees individually, as well as in the broader context of the Board’s overall composition and the Company’s current and future needs.

Qualifications Required for All Directors

In assessing potential directors, including those recommended by stockholders, the Board of Directors and the Governance Committee consider a variety of factors, including the evolving needs of the Board of Directors and the Company as well as other criteria established by the Board of Directors. These include the potential director’s judgment, independence, business and educational background, stature, public service, conflicts of interest, integrity, ethics and ownership of Company stock, as well as his or her level of commitment to the goal of maximizing stockholder value creation and his or her ability and willingness to devote sufficient time to serve on the Board of Directors and to the affairs of the Company. The Board of Directors and the Governance Committee require that each director be a recognized person of high integrity with a proven record of success in his or her field. The Board of Directors does not have a specific policy regarding diversity, but considers race, ethnicity, gender, age, cultural background and professional experience in evaluating director candidates.

Experience, Qualifications and Skills Represented on Our Board of Directors

In addition to the general qualifications highlighted above, in light of the Company’s current needs and its business strategy, our Board of Directors has identified particular expertise, qualifications and skills that are important to be represented on our Board as a whole. The Board of Directors believes it is valuable to have a mix of individuals with expertise as senior executives in the areas of operations, finance, marketing and sales, human resources, compensation and talent management; individuals with enterprise-level information technology expertise; and individuals with expertise in emerging market development, corporate strategy, corporate governance and risk management. The Board of Directors also believes it is important that a significantmeaningful number of our Board membersdirectors have operating knowledge of the industry in which the Company operates, andgeneral management experience or experience serving as a public company director.

2015Board Diversity

The Board of Directors also believes that diversity, including diverse viewpoints, is an important consideration in board composition. When considering director qualifications, the Board of Directors and the Governance Committee evaluate the entirety of each director’s credentials, including factors such as diversity of background, experience, skill, age, race, ethnicity and gender. Although the Board of Directors does not have a written diversity policy, the Governance Committee evaluates the current composition of the Board with a view toward having the Board reflect a diverse mix of skills, experiences, backgrounds and opinions. Depending on the current composition of the Board of Directors, the Governance Committee may weigh certain factors, including those relating to diversity, more or less heavily when evaluating a potential candidate.

2017 Board of Director Nominees

The Board of Directors proposes that each of the tennine nominees named and described below be elected for a one-year term expiring at the 20162018 annual meeting of stockholders or until his or her respective successor is duly elected and qualified. Proxies cannot be voted for more than the number of nominees proposed for election.

Each of our directors and director nominees possesses the judgment and business and educational background required and has a proven track record of success in his or her field as well as a reputation for integrity, honesty and adherence to high ethical standards. They each have business acumen and an ability to exercise sound judgment and a commitment of service to our Company, its stockholders and the Board of Directors. In addition, our Board of Directors is comprised of individuals who collectively possess the particular experiences we consider important to be represented on our Board of Directors as a whole as discussed under the

heading “--Experience, Qualifications and Skills Represented on Our Board of Directors.”Directors” and, as a group, reflect the diverse mix of skills, experiences, backgrounds, and perspectives the Board believes is optimal to foster an effective decision-making environment. Of our nine director nominees, two are women, one of whom chairs our Audit Committee. Two director nominees (including one of the women) have ethnically diverse backgrounds.

The following paragraphs provide information about each director nominee’s age, positions held, principal occupation and business experience for the past five years, the year first elected as a director of ACCO Brands and the names of other publicly traded companies of which he or she currently serves as a director or has served as a director during the past five years.

Each of the nominees below has consented to serve a one-year term if elected. If any nominee should become unavailable to serve as a director, the Board of Directors may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board of Directors. Additionally, in accordance with the Company’s Corporate Governance Principles, each director nominee has submitted a contingent, irrevocable resignation that the Board may accept if the nominee fails to receive the required vote for re-election. In that situation, the Governance Committee (or a special committee consisting solely of independent directors not subject to a failed vote) would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. The Board would then act on this recommendation within 90 days of the date that the election results were certified, and the Company would promptly publicly disclose the Board’s decision.

The following paragraphs provide information about each director nominee’s age, positions held, principal occupation and business experience for the past five years, the year first elected as a director of ACCO Brands and the names of other publicly traded companies for which he or she currently serves as a director or has served as a director during the past five years. For information about the number of shares of common stock beneficially owned by each director see “Certain Information Regarding Security Holders.” There are no family relationships among any of the directors and executive officers of ACCO Brands.

The Board of Directors recommends that you vote FOR the election of all the nominees.

Boris Elisman, Chairman of the Board, President and Chief Executive Officer, Director since 2013.Mr. Elisman, age 52,54, is the Company’s Chairman of the Board, President and CEO.Chief Executive Officer. Mr. Elisman was appointed as Chairman of the Board in May 2016. Prior to becoming our President and Chief Executive Officer (“CEO”)CEO in March 2013, Mr. Elisman served as President and Chief Operating Officer of the Company from 2010 and was President, ACCO Brands Americas from 2008 to 2010. In 2008, he served as President of the Company’s Global Office Products Group and from 2004 to 2008, he served as President of the Company’s Computer Products Group. Prior to that time,

James A. Buzzard, Director since 2012.Mr. ElismanBuzzard, age 62, served as President of MeadWestvaco Corporation, a producer of packaging, specialty papers, consumer and office products, and specialty chemicals (“MWV”) from 2003 until his retirement in March 2014 and was responsible for global operations, including Packaging, Specialty Chemicals, Technology and Supply Chain. Mr. Buzzard began his career with Westvaco in 1978 and held positions of increasing responsibility over many years, including as Executive Vice President responsible for MWV’s Consumer and Office Products Group.

Kathleen S. Dvorak, Director since 2010.Ms. Dvorak, age 60, is retired. Ms. Dvorak served as Executive Vice President and General Manager positionsChief Financial Officer of Richardson Electronics, Ltd., a global provider of engineered solutions and a leading distributor of electronic components to the electron device marketplace from 2007 until her retirement in marketingAugust 2015. Previously, she was Senior Vice President and sales forChief Financial Officer of United Stationers Inc., an office products wholesaler and distributor from 2001 until 2007.

Pradeep Jotwani, Director since 2014. Mr. Jotwani, age 62, is a Continuing Fellow of the Distinguished Careers Institute at Stanford. Mr. Jotwani had a long and successful career at Hewlett-Packard Company serving in a number of different capacities from 20011982 to 2004.2007 and again from 2012 until July 2015. When he retired from Hewlett-Packard in July 2015, he was the Senior Vice President, LaserJet and Enterprise Solutions. Between 2007 and 2012, he served as Senior Vice President at Eastman Kodak Company, which filed for bankruptcy in 2012. Mr. Jotwani served on the board of RealNetworks from 2007 to 2010, and from 2009 until 2010 he served on the board of Westinghouse Solar.

Robert J. Keller, Chairman of the Board, Director since 2005.Mr. Keller, age 61, has63, served as Chairman of the Board of Directors of the Company sincefrom October 2008. He served2008 until May 2016 and as Chief Executive Officer of the Company from October 2008 to March 2013 and as Executive Chairman from March 2013 to March 2015, when he retired as an executive officer of the Company and transitioned to his current role as non-executive Chairman of our Board.2013. Prior to joining the Company, Mr. Keller served as President and Chief Executive Officer and as a director of APAC Customer Services, Inc. from March 2004 until February 2008 and served in various capacities at Office Depot, Inc., most recently as its President, Business Services Group.

George V. Bayly,Thomas Kroeger, Director since 2005.2009.Mr. Bayly,Kroeger, age 72, is a private investor. Since August 2008, Mr. Bayly has served as Principal of Whitehall Investors LLC, a consulting and venture capital firm. Prior to that time, he served as Chairman and interim Chief Executive Officer of Altivity Packaging LLC, interim Chief Executive Officer of U.S. Can Corporation, and Chairman, President and Chief Executive Officer of Ivex Packaging Corporation, a specialty packaging company. Mr. Bayly was a director of General Binding Corporation from 1998 until August 2005, when it was acquired by the Company. He is currently a director of TreeHouse Foods, Inc., and was a director of CCL Industries, Inc. from 2009 to 2013 and a director of Graphic Packaging Holding Company from 2008 until February 2014.

James A.Buzzard, Director since 2012.Mr. Buzzard, age 60, served as President of MeadWestvaco Corporation (“MWV”) from 2003 until his retirement in March 2014 and was responsible for global operations, including Packaging, Specialty Chemicals, Technology and Supply Chain. Mr. Buzzard began his career with Westvaco in 1978 and held positions of increasing responsibility over many years.

Kathleen S. Dvorak, Director since 2010. Ms. Dvorak, age 58, is Executive Vice President and Chief Financial Officer of Richardson Electronics, Ltd., a global provider of engineered solutions and a leading distributor of electronic components to the electron device marketplace. Ms. Dvorak has responsibility for Finance, Information Technology, Human Resources and Legal. Previously, she was Senior Vice President and Chief Financial Officer of United Stationers Inc., an office products wholesaler and distributor from 2001 until 2007.

Robert H. Jenkins, Director since 2007.Mr. Jenkins, age 72, is our Presiding Independent Director. Mr. Jenkins68 is retired. He served as Chairman, President and Chief Executive Officer of Sundstrand Corporation from 1997 to 1999 and as its President and Chief Executive Officer from 1995 to 1997. Sundstrand is an aerospace and industrial company that merged with United Technologies Corporation in June 1999, forming Hamilton Sundstrand Corporation. Mr. Jenkins is currently a director of AK Steel Holding Corporation, Clarcor, Inc. and Jason Industrial, Inc.

Pradeep Jotwani, Director since 2014.Mr. Jotwani, age 60, is a Senior Vice President at Hewlett-Packard Company, where he has worked since 1982, except for the period between 2007 and 2012. From 2010 until 2012, he served as Senior Vice President at Eastman Kodak Company, which filed for bankruptcy in 2012. Mr. Jotwani served on the board of RealNetworks from 2007 to 2010 and from 2009 until 2010 he served on the boards of Westinghouse Solar and two private firms and worked as an operating executive at Vector Capital, a private equity firm.

Thomas Kroeger, Director since 2009.Mr. Kroeger, age 66, is President of Spencer Alexander Associates, which providesprovided management consulting and executive recruiting services. Spencer Alexander Associates is affiliated with Howard & O’Brien Associates, a retained executive search firm. He is also a member of the Operating Council of Kirtland Capital Partners, a private equity firm and currently serves as a director of Precision Dialog Holdings LLC. Previously,services from January 2004 until his retirement in March 2017. Mr. Kroeger previously served as chief human resources officer for each of Invacare Corporation, Office Depot, Inc. and The Sherwin-Williams Company. In each of these positions he was also a member of theeach company’s executive committee.

Graciela Monteagudo, Director since 2016.Ms. Monteagudo, age 50, is Chief Executive Officer of LALA U.S., a dairy company focused on manufacturing and selling drinkable yogurts and value-added specialty milks. Ms. Monteagudo served as Senior Vice President and President, Americas for Mead Johnson Nutrition Company from July 2015 to February 2017 where she was responsible for Mead Johnson’s businesses in North America and Latin America. Between May 2012 and June 2015, Ms. Monteagudo served as Mead Johnson’s Senior Vice President and General Manager, North America and Global Marketing. Ms. Monteagudo served in several capacities for Walmart Mexico, most recently as Senior Vice President and Business Unit Head, Sam’s Club from 2010 to 2012.

Hans Michael Norkus, Director since 2009.Mr. Norkus, age 68, is70, has served as President of Alliance Consulting Group, a business strategy consulting firm.firm since April 1986. Prior to founding Alliance Consulting Group in 1986, Mr. Norkus was Vice President and director of The Boston Consulting Group, where he served for 11 years. Mr. Norkus also currently serves as a director of Genesee & Wyoming, Inc. and served as a director of Overland Storage, Inc. from 2004 to 2011.

E. Mark Rajkowski, Director since 2012.Mr. Rajkowski, age 56,58, has beenserved as Senior Vice President and Chief Financial Officer of Xylem Inc., a global water technology company since March 2016. Mr. Rajkowski served as Senior Vice President and Chief Financial Officer of MWV since 2004.from 2004 until July 2015. He began his career with PricewaterhouseCoopers LLP in 1981, last serving as the managing partner for the Upstate New York Technology Industry Group, and held financial and operating positions of increasing responsibility at Eastman Kodak Company prior to joining MWV.

The table below highlights the primary reasons each individual was selected as a director nominee relative to our desired criteria for a diverse, well-balanced Board of Directors and the particular expertise, qualifications and skills we believe should be represented on our Board of Directors. Many of our directors have experience and expertise beyond those noted below. The table is intended to highlight the specific, unique characteristics which led to each individual’s selection.selection as a nominee.

| Boris Elisman | Robert J. Keller | James A. Buzzard | Kathleen S. Dvorak | Thomas Kroeger | Graciela Monteagudo | Hans Michael Norkus | E. Mark Rajkowski | ||||

| Senior Operating Executive Expertise |  |  |  |  |  | ||||||

| Senior Financial Executive Expertise |  |  | |||||||||

| Senior Marketing/Sales Executive Expertise |  |  |  |  | |||||||

| Senior HR/Compensation/Talent Development Expertise |  | ||||||||||

| Operating Knowledge of Company’s Industry |  |  |  |  |  | ||||||

| Public Company Directorship Experience |  |  |  | ||||||||

| Enterprise Level Information Technology Expertise |  |  | |||||||||

| International Market Development Expertise |  |  |  |  |  | ||||||

| Corporate Strategy Development Expertise |  |  |  |  | |||||||

| Corporate Governance Expertise | |||||||||||

|  | ||||||||||

| Risk Management Expertise |  |  |  |

During 2014,2016, there were sixseven meetings of the Board of Directors. Each director attended at leastmore than 75% of the total number of meetings of the Board of Directors and the committees of the Board of Directors ofon which thesuch director was a member.served. In addition to participation at Board of Directors and committee meetings, our directors dischargedischarged their responsibilities throughout the year

through personal meetings and other communications, including considerable telephone contact with our Chairman ourand CEO and othersother members of senior management regarding matters of interest and concern to ACCO Brands.

8

CORPORATE GOVERNANCE

The Board of Directors has adopted Corporate Governance Principles to assist it in the exercise of its responsibility to oversee the performance of the Company’s management for the benefit of the Company’s stockholders and the maximizationcreation of stockholder value. These principles, along with the charters of the Board of Directors’ committees and other key policies and practices of the Board of Directors, are intended to provide a framework for the governance of the Company.

Director Independence

The Corporate Governance Principles provide that a majority of the members of the Board of Directors, and each member of the Audit, Compensation, and Governance Committees, must meet certain criteria for independence. Based on the NYSE independence requirements, the Corporate Governance Principles (which are available on our website,www.accobrands.com) set forth certain standards to assist the Board of Directors in determining director independence. The Corporate Governance Principles provide that a director will be considered independent only if the Board of Directors affirmatively determines that the director has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company. In addition, the Corporate Governance Principles provide that under no circumstances will a director be considered independent if:

| (a) | the director is a current employee of the Company or any of its subsidiaries, or has an immediate family member who is a current executive officer of the Company or any of its subsidiaries; |

| (b) | the director is a former employee, or any immediate family member is a former executive officer, of the Company or its subsidiaries, until three years after the employment has ended; |

| (c) | the director (1) is a current partner or employee of the firm that is the Company’s internal or external auditor; (2) has been within the last three years, or has an immediate family member that has been within the last three years, a partner or employee of such firm and worked on the Company’s audit during that time; or (3) has an immediate family member who is currently, or within the last three years has been, an employee of such firm and participates in the audit, assurance or tax compliance (but not tax planning) practice; |

| (d) | the director or an immediate family member has been within the last three years employed as an executive officer of another company where any of the Company’s present executive officers serves or has served at the same time on that company’s compensation committee; |

| (e) |

| (f) | the director is a current employee, or any immediate family member is a current executive officer, of a company that makes payments to, or receives payments from, the Company for property or services in an amount that exceeds, in any of the last three fiscal years, the greater of $1 million or 2% of the other company’s consolidated gross revenues. |

Each currently serving member of the Board of Directors, other than Messrs. Elisman and Keller, has been affirmatively determined by the Board of Directors to be independent as defined in the Corporate Governance Principles and in accordance with NYSE independence requirements. Sheila G. Talton, who served as a member of the Board of Directors during 2014 and resigned as a director on March 16, 2015, was also affirmatively determined by the Board of Directors to be independent.

In reaching this conclusion as it relates to Messrs. Buzzard and Rajkowski, the Board considered the fact that during 2014, the Company purchased coated paper products from MWV. See “Transactions with Related Persons.” Mr. Rajkowski is, and until March 31, 2014 Mr. Buzzard was, an executive officer of MWV. After considering all the facts and circumstances related to this transaction, the Board of Directors concluded that its existence did not impair Messrs. Buzzard’s and Rajkowski’s independence.

Mr. Norman H. Wesley servedJenkins currently serves as our Presiding Independent Director until May 2014, when he retired and Mr. Jenkins became our Presiding Independent Director. Mr. Jenkins also served as ourThe Board of Directors intends to appoint a new Presiding Independent Director from September 2008 to May 2013.immediately following Mr. Jenkins’ retirement at the Annual Meeting. The Presiding Independent Director presides at all executive sessions of the independentnon-employee directors. Executive sessions of independentnon-employee directors are held at every regularly scheduled meeting of the Board of Directors. In 2014,2016, each regularly scheduled Board meeting included an independenta non-employee director executive session.

Stockholder Communicationsession, which for certain sessions only the independent directors of the Board attended.

Stockholder Communication

The Board of Directors and management encourage communication from our stockholders. Stockholders who wish to communicate with our management should direct their communication to the Chairman or the Office of the Corporate Secretary, Four Corporate Drive, Lake Zurich, Illinois 60047. Stockholders and other interested parties who wish to communicate with the non-employee or independent directors, any individual director or the Presiding Independent Director should direct their

communication c/ocare of the Office of the Corporate Secretary at the address above. The Corporate Secretary will forward to our Presiding Independent Director any communications intended for the full Board of Directors, for the non-employee or independent directors as a group, or for the Presiding Independent Director. Communications intended for an individual director will be forwarded directly to that director. If multiple communications are received on a similar topic, the Corporate Secretary may, in her discretion, forward only representative correspondence. Any communications that are unrelated to the Company or Board business or that are abusive, inappropriate or in bad taste or present safety, security or privacy concerns may be handled differently.

Annual Meeting Attendance

We do not have a formal policy requiring members of the Board of Directors to attend stockholders’ annual meetings, although all directors are expected to attend. AllEight of the ten directors serving on the Board of Directors at the time of the 20142016 annual meeting of stockholders (other than Mr. Norman H. Wesley and Mr. G. Thomas Hargrove, both of whom retired followingattended the meeting) were in attendance.2016 annual meeting.

Board of Directors’ Leadership Structure

The Board of Directors regularly evaluates whether it is in the best interests of the Company for the positions of Chairman and CEO to be separate or combined. In March 2013, uponconnection with the appointment of Mr. Elisman as our CEO we separatedin March 2013, the role of Chairman and CEO was split, with Mr. Keller being appointedcontinuing to serve as Executive Chairman and, after March 2015, as non-executive Chairman. Among other reasons, separating the Company’s Chairman.

Separating the rolesrole of Chairman and CEO enablesin March 2013 was intended to enable Mr. Elisman to focus his attention on his responsibilities as CEO during his early years in the position, while Mr. Keller’s continued role as Chairman provideswould provide continuity in leadership of the Board of Directors.Directors and support a smooth transition of executive leadership of the Company.

In May 2016, it was determined to again combine the roles of Chairman and CEO and Mr. Elisman, our CEO, was appointed Chairman. The Board believesdecision to combine the roles reflects the successful full transition of the Company’s leadership to Mr. Keller’s continued service asElisman during the three years since he first assumed the position of CEO. We believe that having a director is valuable tosingle leader for the Company given his familiarity withis advisable in order to convey to our customers, business partners, investors and the Company’s overall business and its short- and long-term strategies. As CEO, Mr. Elisman reports directly to the Board of Directors.other stakeholders strong, unified leadership.

Although the roles of Chairman and CEO have been separated,combined, Mr. KellerElisman’s dual role is not independent. Accordingly, we continue to have aappropriately balanced by the role of the Presiding Independent Director, who presides at meetings of all independentnon-employee directors in executive session. This allows directors to speak candidly on any matter of interest, without the Chairman theand CEO or other members of management present. Mr. Jenkins, ourThe Presiding Independent Director works closely with Messrs. Keller andMr. Elisman in establishing the agenda for each meeting of the Board of Directors and acts as a conduit for contact between Messrs. Keller andMr. Elisman and the other directors. The Presiding Independent Director, although not required to do so, also endeavors to attend as many Board committee meetings as possible.

Further, it is our view that the independent members of our Board of Directors and the four standing Board committees provide appropriate oversight and an effective balance to ourthe combined Chairman and our CEO roles.role. For additional information regarding the roles and responsibilities of our Audit Committee, Compensation Committee, Governance Committee, and Finance and Planning Committee (the “Finance Committee”), see “--Committees.” The Chairman and the CEO dodoes not serve on any of our standing committees and, as discussed in more detail below, the entire Board of Directors is actively involved in overseeing our risk management. We believe the independent composition of our principal Board committees, together with the Presiding Independent Director, function, provides balanced leadership and consistent, effective oversight of our management and our company.Company.

Risk Oversight

Our entire Board of Directors believes that an effective enterprise risk management program (“ERM”) will identify in a timely manner the material risks we face, and communicate necessary information about those risks to senior management and, as appropriate, to the Board of Directors or its relevant committees. Additionally, our Board of Directors believes an effective ERM will support the implementation of appropriate and responsive risk management strategies, and integrate risk management into our decision-making. Our senior management has primary responsibility for managing enterprise risks as well as the day-to-day risks associated with our business, including strategic, operational, financial, legal, regulatory, technology, geo-political, reputational, and emerging risks.

Our Board is actively involved inresponsible for the oversight of our risk management. Our ERM includes policies and procedures designed to help identify, evaluate, monitor, manage and mitigate the major internal and external risks we are exposed to in our business and to align risk-taking appropriately with our efforts to increase stockholder value. The Board currently oversees our risk management primarily thorough the Governance Committee which oversees the ERM policies and procedures established by management and the delegation of specific areas of risk to other Board committees, as well as through the Audit Committee which receives regular reports from the Company’s Vice President of Internal Audit and its General Counsel. Our Board receives regular reports from

each Board committee regarding topics discussed at the committee meetings, which include the areas of risk overseen by the committees.

| ● | Governance Committee:In addition to overseeing our ERM policies and procedures, our Governance Committee is responsible for reviewing management’s activities in the areas of product liability/safety, and anti-corruption and bribery. Our Governance Committee also oversees management’s administration of the Company’s corporate social responsibility and sustainability programs and periodically reviews the structure of our Board’s committees and charters to ensure appropriate oversight of risk. |

| ● | Audit Committee:Our Audit Committee oversees certain financial risks associated with the preparation of the Company’s financial statements and our financial compliance activities, including the adequacy of our internal controls over financial reporting, our disclosure controls and procedures and our information technology general controls. The Audit Committee also oversees management actions and controls related to cyber and data security risks, disaster recovery and business continuity. |

| ● | Finance Committee:Our Finance Committee assists in monitoring and overseeing financial risks with respect to the Company’s capital structure, investments, use of derivatives and hedging instruments, currency exposure and other business and financing plans and policies. |

| ● | Compensation Committee:Our Compensation Committee considers risk and structures our executive compensation programs with an eye to providing incentives to appropriately reward executives for growing stockholder value without undue risk taking. It reviews, at least annually, the relationship between the Company’s ERM, corporate strategy and executive compensation. See “Compensation Discussion and Analysis--Discussion and Analysis--Role of our Compensation Committee and Management.” Oversight of the Company’s succession planning also is included in the Compensation Committee’s risk oversight responsibilities. |

In addition to the activities undertaken by each of the Board committees, the Board as a whole participates in regular discussions among directors and with senior management with respect to several core subjects in which risk oversight is an inherent element, including strategy, operations, finance, mergers and acquisitions and legal matters. Operational and strategic presentations by management to the Board of Directors include consideration of the challenges and risks to our business, and the Board of Directors and management actively engage in discussions on these topics.business. At least annually, theour Board of Directors reviews management’s long-term strategic plans and the risks associated with carrying out thosethese plans. The presentation for that strategic review is compiled by senior management and approved by the CEO.

In addition, our Governance Committee oversees our enterprise risk management activities and management’s administration of the Company’s corporate social responsibility and sustainability programs. Each of our other Board of Directors’ committees also considers risk within its area of responsibility. Our Audit Committee oversees financial risk and reviews legal and compliance matters and the adequacy of our internal controls over financial reporting and disclosure controls and procedures, including our

information technology general controls. The Audit Committee also periodically requests management to address specific risk issues, including data security, at its meetings. The Finance Committee assists in monitoring and overseeing financial risk with respect to the Company’s capital structure, investments, use of derivatives and hedging instruments, business and financing plans and policies, as well as financing requirements. Likewise, our Compensation Committee considers risk and structures our executive compensation programs with an eye to providing incentives to appropriately reward executives for growing stockholder value without undue risk taking. See “Compensation Discussion and Analysis--Discussion and Analysis--Role of Our Compensation Consultant and Management.” Our Governance Committee periodically reviews the structure of our Board’s committees and charters to ensure appropriate oversight of risk.

Committees

The Board of Directors has established an Audit Committee, a Compensation Committee, a Governance Committee and a Finance Committee, each of which operates pursuant to a written charter that is available on our website (www.accobrands.com). The Company also has an Executive Committee that consists of Messrs. KellerElisman (Chairperson), ElismanKeller and Jenkins. The Executive Committee has all the power and authority of the Board of Directors except for specific powers that by law must be exercised by the entire Board of Directors. Although Messrs. Buzzard and Rajkowski are independent under our Corporate Governance Principles and the NYSE standards, the Board of Directors decided that neither of them shouldcurrently serve on the Compensation Committee, Governance Committee or Audit Committee, respectively, as an acknowledgment that some third parties may not consider them independent for a period of time due to their employment with MWV prior toat the merger of a subsidiarytime of the Company withCompany’s acquisition of the consumer and office products divisionbusiness of MWV in May 2012 (the “Mead C&OP Merger”).2012. Beginning May 2017, we believe a sufficient amount of time will have passed since the Company’s acquisition of MWV’s consumer and office products business to alleviate such independence concerns, which would enable the Board to consider Messrs. Buzzard and Rajkowski for appointment to the Compensation, Governance or Audit Committees in the future.

Audit Committee

| Members | The members of the Audit Committee are Ms. Dvorak (Chairperson), Mr. Jotwani, |

| Number of Meetings Last Year | Ten | |||

| Primary Functions | Oversees (1) the integrity of our financial statements and our accounting and financial reporting processes, (2) the independence and qualifications of our independent auditors, (3) the performance of the independent auditors and our internal audit function, and (4) our compliance with legal and regulatory requirements. As part of its responsibilities, the Audit Committee, among other things: | |||

| retains and oversees an independent, registered public accounting firm to serve as the Company’s independent auditors to audit our financial statements and monitors the independence and performance of our independent auditors; | ||||

| approves the scope of audit work and reviews reports and recommendations of our independent auditors; |

| meets separately with our independent auditors on a quarterly basis; |

| reviews the annual internal audit plan, summaries of key reports and updates on the results of internal audit work; |

| reviews internal audit staffing levels, qualifications and annual expense budgets; |

| pre-approves all audit and permissible non-audit services to be provided by our independent auditors in accordance with policies and procedures established and maintained by the Audit Committee; |

| reviews and discusses with management our financial statements and quarterly and annual reports to be filed with the SEC, our earnings announcements and related materials; |

| reviews and discusses with management the adequacy and effectiveness of our disclosure controls and procedures and our internal control over financial reporting, including any material weaknesses, significant deficiencies or changes in internal controls; |

| discusses with our independent auditors our annual and quarterly financial statements; |

| reviews our policies regarding financial risk assessment and risk management and discusses with management the Company’s financial risk |

| establishes and oversees procedures for receiving and responding to concerns regarding accounting, internal |

| reviews and approves (or ratifies where appropriate) certain categories of related-party transactions. |

Compensation Committee

| Members | The members of the Compensation Committee are Messrs. Kroeger (Chairperson), Bayly and Norkus. Each member meets the independence standards of our Corporate Governance Principles and the NYSE, as well as qualifies as a “non-employee director” within the meaning of Rule 16b-3 promulgated under the Exchange Act and as an “outside director” within the | |||

| meaning of Section 162(m) of the Internal Revenue Code, as amended (the “Code”). |

| Number of Meetings Last Year | Seven | |||

| Primary Functions | Oversees compensation and benefit programs for our executive officers and other members of senior management with a view towards attracting, motivating, and retaining high-quality leadership and compensating those individuals in a manner that is aligned with stockholders’ interests, consistent with competitive practices, commensurate with performance and in compliance with the requirements of appropriate regulatory bodies. As part of its responsibility the Compensation Committee, among other things: | |||

| establishes the Company’s compensation philosophy; | ||||

| annually reviews and recommends to the Board of Directors the compensation of our CEO and evaluates his performance against incentive |

| establishes and approves the compensation for our other executive officers; |

| administers, reviews and exercises the Board of Directors’ authority with respect to equity-based, and annual and long-term incentive compensation plans of the Company; determines and approves, or recommends for approval, grants of awards under such plans to executive officers; and |

| delegates, at its discretion, to the CEO the authority to grant equity-based and incentive awards to non-executive employees; |

| exercises the Board of Directors’ authority with respect to the oversight and, where applicable, administration of the Company’s health and benefit and defined benefit, retirement and supplemental retirement plans, including the Company’s 401(k) plan; |

| exercises the Board of Directors’ authority with respect to employment, compensation, severance and change-in-control arrangements or agreements with executive officers, and, if applicable, other key employees as it may determine, and oversees management’s administration of such agreements or arrangements; |

| oversees the succession planning processes for executive officers and assists the Board of Directors in establishing such processes for our CEO; |

| oversees risk management with respect to the Company’s compensation policies and practices; and |

| establishes and reviews guidelines requiring our executives and other officers to maintain certain levels of stock ownership in the Company. |

Corporate Governance and Nominating Committee

| Members | The members of the Governance Committee are Messrs. Norkus (Chairperson), Bayly, Jotwani and Kroeger. Each member meets the independence standards of our Corporate Governance Principles and the NYSE. | |||

| Number of Meetings Last Year | Eight | |||

| Primary Functions | Develops and oversees the Company’s corporate governance policies and provides advice with respect to corporate governance, the rights and interests of stockholders, and the organization, evaluation and functioning of the Board of Directors and its committees. The Governance Committee also identifies, | |||

| reviews and recommends candidates for election to the Board of Directors and its committees. As part of its responsibility, the Governance Committee, among other things: |

| annually reviews and, if desirable, recommends changes to the Company’s |

| reviews and provides recommendations with respect to the composition and structure of the Board of Directors and the duties, powers, composition and structure of the Board’s committees; |

| establishes and reviews criteria relating to the qualifications, candidacy, service and tenure of directors and the procedures for the consideration of director candidates recommended by the Company’s stockholders; |

| identifies and evaluates potential director candidates and recommends nominees for election or re-election as members of the Board of Directors; |

| establishes and reviews criteria and qualifications for membership on Board’s committees and recommends directors for membership on such committees; |

| ● | ||||

| together with our Presiding Independent Director, manages the annual performance review process of the Board of Directors and the Board’s committees; |

| annually reviews and, if desirable, makes recommendations regarding compensation arrangements for non-employee directors, and administers the Company’s non-employee director deferred compensation plan; |

| develops, recommends and periodically reviews the non-employee director stock ownership guidelines; and |

| oversees management’s administration of the Company’s |

Finance and Planning Committee

| Members | The members of the Finance Committee are Mr. Rajkowski (Chairperson), Ms. Dvorak, | |||

| Number of Meetings Last Year | Five | |||

| Primary Functions | Assists the Board of Directors in fulfilling its responsibilities to monitor and oversee the Company’s financial affairs with respect to the Company’s capital structure, investments, business and financing plans and policies, as well as financing requirements. The Finance Committee also evaluates specific financial proposals, plans, strategies, transactions and other initiatives. As part of its responsibility the Finance Committee, among other things: | |||

| reviews the capital structure and financing requirements of the Company, as well as the Company’s debt ratings and bank credit facility arrangements, and makes recommendations to management concerning the Company’s liquidity needs; |

| reviews and approves the Company’s policies related to use of hedging and derivative instruments, including, among other things, approving any future authorizations for the Company and its subsidiaries to enter into swaps; |

| reviews and makes recommendations to management regarding the annual business plan; |

| reviews and makes recommendations to management on any proposals for equity and debt transactions under consideration, including, but not limited to, issuances, repurchases, redemptions, retirements and recapitalizations; |

| reviews and makes recommendations to management on any strategic actions under consideration, including any proposed acquisitions, divestitures, mergers, strategic alliances, investments or other actions to maintain or enhance stockholder value; |

| reviews and makes recommendations to management regarding the Company’s dividend policy; and |

| annually reviews the funding and investment performance of the Company’s defined benefit, retirement and supplemental retirement plans, including the Company’s 401(k) | plan. |

Board and Committee Self-Evaluation

Under the direction of the Governance Committee and our Presiding Independent Director, the Board of Directors and each Committee conducts an annual review of its performance and effectiveness.

Director Nomination Process

In identifying and evaluating director candidates for recommendation as nominees to the Board of Directors, the Governance Committee will determine, among other things, whether there are any evolving needs of the Board of Directors and the Company that require a director with particular expertise, experience or experiencebackground to fill that need. The Governance Committee may retain a third-party search firm to locate and provide information on candidates that meet the needs of the Board of Directors at that time. The Chairperson of the Governance Committee and some or all of the members of the Governance Committee and the Board will interview potential candidates that are deemed appropriate. If the Governance Committee determines that a potential candidate meets the needs of the Board of Directors, has the qualifications, and meets the standards set forth in the Company’s Corporate Governance Principles and as further described under the headings “Election of Directors--Qualifications Required for allAll Directors” and, “--Experience, Qualifications and Skills to Be Represented on Our Board of Directors”, and “--Board Diversity,” it will vote to recommend to the Board of Directors the nomination of the candidate.

The policy of the Governance Committee is to consider director candidates recommended by stockholders if properly submitted to the Governance Committee. Stockholders wishing to recommend persons for consideration by the Governance Committee as nominees for election to the Board of Directors can do so by writing to the Office of the Corporate Secretary of ACCO Brands Corporation at Four Corporate Drive, Lake Zurich, Illinois 60047. Recommendations must include the proposed nominee’s name, biographical data and qualifications as well as a written statement from the proposed nominee consenting to be named as a nominee and, if nominated and elected, to serve as a director. The Governance Committee will then consider the candidate and the candidate’s qualifications. The Governance Committee may contact the stockholder making the nomination to discuss the qualifications of the candidate and the reasons for making the nomination and may interview the candidate if the Governance Committee deems the candidate to be appropriate. The Governance Committee may use the services of a third-party search firm to provide additional information about the candidate in determining whether to make a recommendation to the Board of Directors.

The Governance Committee’s nomination process for stockholder-recommended candidates and all other candidates is designed to ensure that the Governance Committee fulfills its responsibility to recommend candidates that are properly qualified to serve the Company for the benefit of all of its stockholders, consistent with the standards established by the Governance Committee under our Corporate Governance Principles. Stockholders seeking to nominate persons for election to our Board of Directors must comply with our procedures for stockholder nominations described under the heading “Submission of Stockholder Proposals and Nominations.”

Compensation Committee Interlocks and Insider Participation

All current members of the Compensation Committee are considered independent under our Corporate Governance Principles. No interlocking relationships exist between the Board of Directors or the Compensation Committee and the board of directors or compensation committee of any other company.

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors and executive officers are subject to Section 16 of the Exchange Act, which requires them to file with the SEC reports regarding their ownership and changes in beneficial ownership of our equity securities. Reports received by the Company indicate that all directors and executive officers have filed all requisite reports with the SEC on a timely basis during 2014.2016.

TRANSACTIONS WITH RELATED PERSONS

The Company recognizes that transactions between the Company and any of its directors or executive officers can present potential or actual conflicts of interest and create the appearance that Company decisions are based on considerations other than the best interests of the Company and its stockholders. Therefore, as a general matter and in accordance with the Company’s Code of Business Conduct and Ethics, it is the Company’s preference to avoid such transactions. Nevertheless, the Company recognizes that there are situations where such transactions may be in, or may not be inconsistent with, the best interests of the Company. Therefore, the Company has adopted a formal written policy which requires the Audit Committee to review and, if appropriate, to approve or ratify any such transactions. Pursuant to the policy, the Audit Committee will review any transaction in which the Company is, or will be, a participant and the amount involved exceeds $120,000, and in which any of the Company’s directors or executive officers or any of their immediate family members had, has or will have a direct or indirect material interest. After its review, the Audit Committee will only approve or ratify those transactions that are in, or are not inconsistent with, the best interests of the Company and its stockholders, as the Audit Committee determines in good faith. The Audit Committee has also directed the Company’s General Counsel and internal audit department to review the Company’s compliance with this policy on at least an annual basis.

During 2014, the Company purchased approximately $1.2 million of coated paper products from MWV in a series of transactions. This amount represents significantly less than one percent of either party’s reported annual revenues. Management has determined that such transactions were on terms at least as favorable to the Company as terms otherwise available in the marketplace. Management has also been advised by MWV that Messrs. Buzzard’s and Rajkowski’s compensation was not impacted by these transactions.

20142016 DIRECTOR COMPENSATION